If your family contains opposite-gender parents in the first marriage for each and one or more kids, all healthy and thriving, your estate plan will probably be pretty straightforward. But if not, it’s not as simple and you have a lot of company.

Although the vast majority of Americans have estates that fall under the estate and gift tax exemption, the exemption is set to be cut in half in 2026. Proper planning may be necessary to make sure you are taking full advantage of the current exemption and aren’t negatively affected when it decreases.

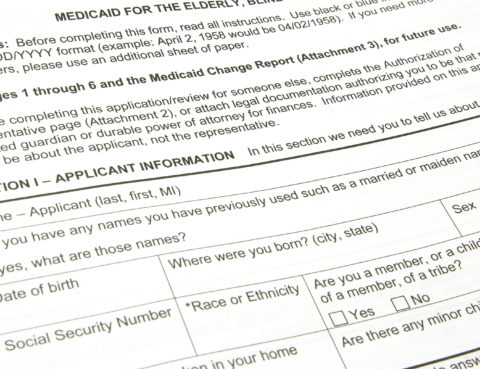

Medicaid applicants must prove that they have limited income and assets in order to be eligible for long-term care benefits. Before beginning the application process, it is helpful to understand what is required prove your eligibility.

Summer time is is almost over, but the heat is still here. Cool down with this refreshing Fruit punch as the season winds down. Enjoy the Festive Fruit Punch and…